Important notification on data privacy and cookie notice: We use cookies to ensure you get the best experience. By continuing to browse our site, you are agreeing to our use of cookies. Visit our online privacy statement.

- Please enter a search term.

Regions

Languages - Philippines

-

You are on the Sun Life Financial Philippines website. Language selection is English. Expand or collapse region and language section. PHILIPPINES | EN

-

Insurance

Insurance to meet your needs

Life Protection / Wealth Transfer

-

Investments

The Conservative Funds

Sun Life Prosperity Funds

-

Life Goals

Inspiring articles for a brighter life

Bright ideas to achieve financial freedom

-

About us

Who we are

Become an employee

Become an advisor

Sun Life Foundation

Client tools

Payment channels

- Please enter a search term.

-

PHILIPPINES | EN

Regions

Languages - Philippines

RegionsLanguages - Home

-

Insurance

Insurance

- Insurance overview

- Income continuation

- Education

- Retirement

- Estate preservation

- Preparing for life milestones

- Health protection

- Business owners insurance packages

- Group life

- Digital insurance

-

Investment-linked insurance funds

- Back

- Investment-linked insurance funds overview

- Captains Fund

- Index Fund

- Growth Plus Fund

- Dynamic Fund

- MyFuture Fund

- Equity Fund

- Bond Fund

- Balanced Fund

- Income Fund

- Opportunity Fund

- Growth Fund

- Money Market Fund

- Global Income Fund

- Global Opportunity Fund

- Opportunity Tracker Fund

- Global Opportunity Payout Fund

- Peso Global Opportunity Fund

- Peso Global Opportunity Payout Fund

- Peso Global Sustainability Growth Fund

- Supplementary benefits

- Tools and services

- Bright Ideas

- VUL Fund Prices

-

Investments

Investments

- Life Goals

-

About us

About us

- Contact Us

- Where to pay

- FAQs

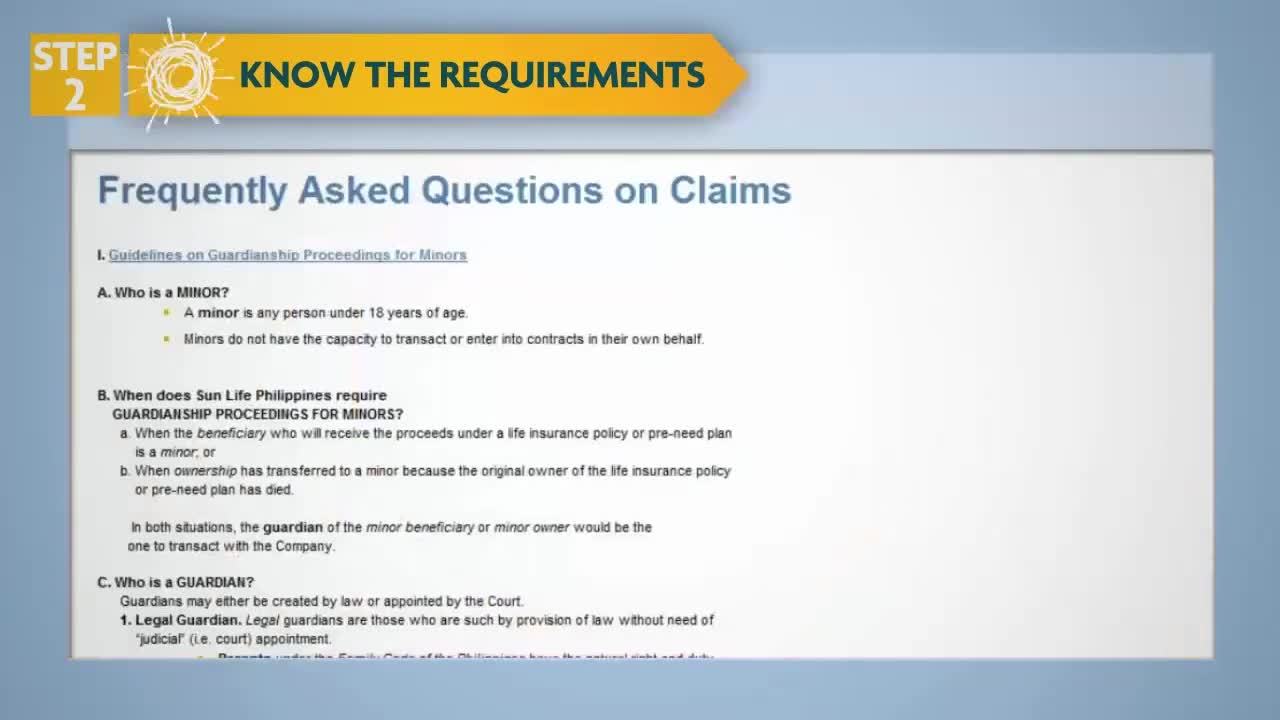

How to file a claim

STEP 1: Notify Sun Life about your claim.

To file a claim, simply click the Claim Notification Form (see links below) and type the requested information.

Claim for Free Diagnostic Procedures

When all fields have been completed, click the Submit button.

You may also notify us by:

- contacting your Financial Advisor

- visiting our nearest Financial Store or Client Service Center

- calling our Client Care at telephone number (632) 8849-9888 from Mondays to Fridays, 8:00 am to 7:00 pm, or

- mailing your notice to:

Claims Services

Sun Life of Canada (Phils.), Inc.

2/F Sun Life Centre

5th Avenue corner Rizal Drive

Bonifacio Global City

Taguig City, Philippines 1634

Important Reminders:

- Submit certified true copies only.

✓ Photocopies,except for IDs, are not acceptable.

✓ Photocopies of IDs may be submitted provided the original copies are presented for verification.

- Documents submitted to Sun Life Canada (Philippines), Inc (SLOCPI) will not be returned.

- Always attach a photocopy of the claimant's valid ID (any government-issued ID with photo and signature) with the basic claim requirements.

- The parties representing the claimant or beneficiary should submit the following: authorization letter from the claimant/beneficiary, 2 valid government-issued IDs of the claimant/beneficiary and 2 valid government-issued IDs of the representative.

- Claims occurring within 2 years from date of policy issue or last reinstatement are contestable and take longer to process.

- Beneficiaries below age 18 are considered minors and must be represented by their legal guardian.

- Sun Life strictly follows the provisions of the Philippine laws involving minors, estates and disqualified beneficiaries.

- For Living Benefits Claims, please check your policy contract for the covered illnesses and their definitions.

- We may ask for additional documents after reviewing the requirements you submitted.

Instruction: Click the title of the requirement to print the checklist and form. Acrobat Reader software is required to download.

1. Claims on Life Insurance Policies

A. Death Claim

- Checklist

- Forms (submit the form appropriate to your case)

- Claim Form

- Attending Physician’s Statement

- Authorization

- Affidavit of Guardianship (Father as Guardian – default)

- Affidavit of Guardianship (Mother as Guardian – in the absence or incapacity of the Father)

- Affidavit of Guardianship (Other Relative as Guardian – in the absence or incapacity of both the Father and Mother)

B. Living Benefit Claim

- SUN Fit and Well

- Checklist (Blood Related)

- Checklist (Cancer Related)

- Checklist (Child Conditions)

- Checklist (Gastrointestinal Related)

- Checklist (Heart Related)

- Checklist (Kidney Related)

- Checklist (Liver Related)

- Checklist (Lung Related)

- Checklist (Neurological Related)

- Checklist (Others)

- Forms (submit the form appropriate to your case)

- Sun Senior Care

- Checklist

- Forms (submit the form appropriate to your case)

- Hospital Income Benefit

- Checklist

- Forms (submit the form appropriate to your case)

- Child Delivery

- Checklist

- Forms (submit the form appropriate to your case)

- Female Critical Illness and Maternity Benefits

- Checklist

- Forms (submit the form appropriate to your case)

- Waiver of Premium due to Disability (applicable to Total Disability Benefit, Advance Payment on Disability Benefit, Premium Coverage During Total Disability of Initial Owner, or Contingent Semestral Education and Premium Coverage)

- Checklist

- Forms (submit the form appropriate to your case)

- Use these forms for continuation of Waiver of Premium

- Checklist

- Critical Condition / Critical Illness Benefit

- Checklist - Critical Condition

- Checklist - Critical Illness Benefit

- Forms (submit the form appropriate to your case)

- Checklist - Critical Condition

- Living Benefit Rider

- Checklist

- Forms (submit the form appropriate to your case)

- Accidental Dismemberment and Disablement Benefits

- Checklist

- Forms (submit the form appropriate to your case)

2. Claims on Insurance Riders on Pre-Need Plans (Education and Pension)

A. Death Claim

- Checklist

- Forms (submit the form appropriate to your case)

- Claim Form

- Attending Physician’s Statement

- Authorization

- Affidavit of Guardianship (Father as Guardian – default)

- Affidavit of Guardianship (Mother as Guardian – in the absence or incapacity of the Father)

- Affidavit of Guardianship (Other Relative as Guardian – in the absence or incapacity of both the Father and Mother)

B. Credit Group Disability / Personal Accident Protection / Scholar Accident Protection

- Credit Group Disability

- Checklist

- Forms (submit the form appropriate to your case)

C. Accidental Dismemberment or Family Accident Protection – Dismemberment Claim

- Checklist

- Forms (submit the form appropriate to your case)

3. Claims on Matured Policies

- Checklist

- Forms (submit the form appropriate to your case)

Please download and fill out a copy of the Request Form if you want your Maturity, Death and Living benefit (HIB, CIB, etc...) claims to be deposited to a specific bank account.

The requirements checklists and claim forms are also available at the following:

- Advisor’s Portal

- Nearest Financial Store or Client Service Center

Once the claim requirements are ready, submit the requirements to the following:

- Your Financial Advisor

- Nearest Financial Store or Client Service Center

I. Guidelines on Guardianship Proceedings for Minors

II. What will happen if the primary beneficiary dies?

A. If there is one (1) primary beneficiary

1. If the primary beneficiary pre-deceases (dies ahead of) the insured, the death claim proceeds shall be paid to the Contingent beneficiary/ies

a. What if there is no contingent beneficiary?

The death claim proceeds shall vest on the estate of the insured. (See “Guidelines on Settlement of Estates”)

2. If the life insured pre-deceases the primary beneficiary and then subsequently the primary beneficiary dies before the claim is settled, the death claim proceeds shall vest on the estate of the primary beneficiary.

B. If there are two (2) or more primary beneficiaries

1. If one (1) primary beneficiary pre-deceases the insured, proceeds shall be paid to the surviving primary beneficiary/ies.

2. If all the primary beneficiaries pre-decease the insured, proceeds shall be paid to the contingent beneficiary/ies.

a. What if there is no contingent beneficiary?

The death claim proceeds shall vest on the estate of the insured upon the insured’s death.

3. If the life insured pre-deceases the primary beneficiaries and subsequently one or some of the primary beneficiaries die before the death claim is settled, the proceeds shall be paid to the surviving primary beneficiary/ies and to the estate of the deceased primary beneficiary/ies.

4. If the life insured pre-deceases all the primary beneficiaries and subsequently all of the primary beneficiaries die before the death claim is settled, proceeds shall vest on the estates of all the primary beneficiaries

C. What are the rights of the contingent beneficiaries?

Contingent beneficiaries, if living, are entitled to receive the death claim proceeds only when all the primary beneficiaries had died ahead of the life insured

III. Naming the spouse as beneficiary

A. What to submit on top of the basic requirements?

- If married, submit Marriage Contract issued by the National Statistics Office (NSO) or Philippine Statistics Authority (PSA)

- If not married and both parties do not have legal impediment to marry, submit

- Affidavit re No legal impediment** to marry [form may be secured from Claims Services]

- Certificate of No Marriage (CENOMAR) of both parties issued by the National Statistics Office (NSO) or Philippine Statistics Authority (PSA)

- ** Both parties are free to marry i.e. they have never been previously married

IV. What will happen if there is a legal impediment to marry?

Civil Code

“Art 739. Donation is void if it is made between people guilty of adultery/concubinage at time of donation, between people guilty of criminal offense and to a public officer and his family by reason of his office.”

“Art 2012. Any person who is forbidden from receiving any donation under article 739 cannot be named beneficiary of a life insurance policy by the person who cannot make any donation to him, according to said article.”

If the common law spouse is the sole primary death beneficiary

- If there is a contingent beneficiary, the proceeds shall be paid to the contingent beneficiary.

- If there is no contingent beneficiary, the proceeds shall vest on the estate of the insured.

If there are two or more primary death beneficiaries.

The proceeds shall be distributed to other primary beneficiaries.

V. When a spouse is named as a primary beneficiary, what will happen in case the marriage was annulled after the policy had been issued and the Policyowner-insured failed to change the beneficiary designation prior to his/her death?

The share of the designated spouse-beneficiary shall still be payable to him/her once the claim requirements have been completed because at the time he/she was designated as a beneficiary of the policy, the marriage was still valid.

- Naming “Children Borne of this Marriage” as beneficiaries

A. What to submit on top of the basic requirements?

1.Affidavit re name, number and birth dates of the children borne of the marriage between the spouses

2.Certified true copy of the children’s Birth Certificate

B. What if there is a minor child?

Refer to Guidelines on Guardianship Proceedings for Minors

- What to do when claim proceeds become payable to the estate?

- When claim proceeds become payable to the Estate, the procedures provided by law should be followed (See “Guidelines on Settlement of Estates”)

- To whom will the ownership of the policy be transferred after the death of the initial owner?

A. To whom will the ownership be transferred?

1. For juvenile policies (policies issued on the life of a minor)

Ownership will automatically be transferred to the life insured once the initial owner dies, regardless if there is an irrevocable beneficiary.

Note: The “juvenile” policy still requires that the minor owner deal through his/her guardian for any policy transaction (e.g. applying for an advance, changing the beneficiaries, etc.)

2. For adult policies (policies issued on the life of an adult purchased by another adult)

Ownership will automatically be transferred to the life insured once the initial owner dies, regardless if there is an irrevocable beneficiary.

B. How to request for transfer of ownership?

1. If there is an in-force Premium Coverage Upon Death or Disability of Initial Owner (WPDD, WPD or CSEPC for Sun Heritage Plans) attached to the policy, there is no need to request for the transfer of ownership. Since a claim for these benefits will be filed, the transfer of the ownership of the policy will be communicated by the Claims Services to the Policy and Plan Change Section once the certified true copy of the initial owner’s Death Certificate is received.

(See list of requirements above or click on this link to download the Requirements Checklist for Waiver of Premium)

2. If there is no in-force Premium Coverage Upon Death or Disability of Initial Owner (WPDD, WPD or CSEPC for Sun Heritage Plans) attached to the policy, a certified true copy of the Death Certificate has to be forwarded to the Policy and Plan Change Section so transfer of ownership may be processed.

- Guidelines on Guardianship Proceedings for Incompetents

- IMPORTANT NOTE:

Sun Life has issued the Guidelines on Guardianship Proceedings for Minors, Incompetents and Settlement of Estates merely as a general tool for the assistance of claimants. These guidelines do not and are not meant to serve as legal advice to claimants. Claimants are advised and encouraged to seek legal advice of their own.

When you're ready, file a claim now. Check your claim status using our service tracker.

.png)