A Mutual Fund is an investment company that pools together money from different investors, then invests these in various assets depending on the goal of the fund. The company issues investors shares or units, which represent their investments.

At Sun Life Asset Management Company, Inc. (SLAMCI), we have a suite of 16 mutual funds called the Sun Life Prosperity Funds.

Watch this short video for more information on how mutual funds work.

There are four (4) basic types of mutual funds in the market:

- Money Market Funds invest in short-term debt instruments like time deposits. (e.g. Sun Life Prosperity Money Market Fund)

- Bond Funds invest in long-term debt instruments of governments or corporations.(e.g. Sun Life Prosperity GS Fund and Sun Life Prosperity Bond Fund)

- Balanced Funds invest both in shares of stock and debt instruments.(e.g. Sun Life Prosperity Balanced Fund)

- Stock Funds / Equity Funds invest primarily in shares of stock.(e.g. Sun Life Prosperity Philippine Equity Fund and Sun Life Prosperity Philippine Stock Index Fund)

SLAMCI also has a suite of target date funds, the Sun Life Prosperity Achiever Funds, which grow one’s mutual fund investments over a specific period of time. Target date funds are ideal for addressing a financial goal slated for a future date, such as retirement or funding a child’s education.

For assistance on which fund suits you best, talk to your Sun Life Financial Advisor or email us at sunlink@sunlife.com.

NAVPS/ NAVPU (net asset value per share/ unit) is the value of one share/ unit of a mutual fund. This is computed by dividing net assets by the number of shares/ units held by an investor. Fund managers buy and sell shares/ units in a mutual fund according to the NAVPS/ NAVPU, which changes every business day depending on the market value of the assets of the fund.

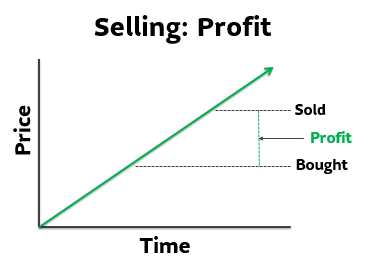

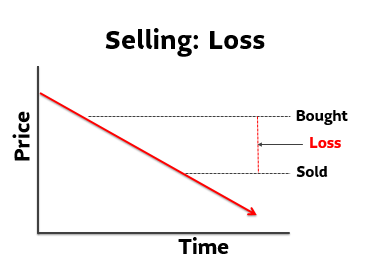

If the NAVPS/ NAVPU of the mutual fund you are invested in increases or appreciates, you can sell your mutual fund shares/ units for a profit. In the same way, if the NAVPS/ NAVPU of the mutual fund you are invested in decreases or depreciates, you may realize a loss if you redeem.

Selling: Profit

Selling: Loss

Like any other investment instrument, mutual funds are best held long-term especially for mutual funds that have investment objectives of capital growth such as equity funds.

Strategies such as regular investing (via Auto-Invest with our Partner Banks BDO, BPI, Metrobank, Security Bank, or Sun RISE) help in averaging the cost of your shares/ units to minimize risk and maximize earning potential.

Mutual funds allow you to invest in a range of financial outlets, minimizing the risks related to credit, interest rates, foreign investment, and the markets, among others. Historically, mutual funds have generated higher returns compared to traditional deposits, enabling investors to potentially beat inflation and achieve their long-term financial goals. Best of all, you can start investing with just P100!

For a list of other mutual fund benefits, click here. To see other investment options, click here.

For assistance, talk to your Sun Life Financial Advisor or call our Client Care Center at 8-849-9888.

Get Bright Ideas about Mutual Funds with Make it Mutual.

.png)